The microcap market, once a hotbed of speculative fervor and get-rich-quick dreams, appears to be facing a period of waning interest. Anecdotal evidence, such as the recent muted response to Medipharm Labs’ (LABS:TSX) significant partnership announcement in Brazil (January 8, 2025), suggests a shift in investor sentiment. Even positive news that might have once ignited a buying frenzy now seems to fall on deaf ears. While the cannabis sector’s weakness undoubtedly plays a role, the issue appears to be more systemic, affecting a broader swath of the microcap landscape.

The Anecdotal Evidence: A Shift in Sentiment

For years, the microcap market, particularly in Canada, was characterized by a vibrant, albeit speculative, investor base. Small companies with big promises could attract significant attention, and positive news often translated into rapid share price appreciation. However, recent observations suggest a change in this dynamic.

Medipharm Labs, a cannabis company, recently secured a major partnership in Brazil. In the past, such an announcement would have likely triggered a surge in buying activity and a substantial jump in the company’s share price. Instead, the market’s response was grossly underwhelming. This anecdotal evidence, while specific to one company, raises broader questions about the current state of investor interest in the microcap space.

The Data Speaks: A Decade of Trends on the CSE, TSX-V, OTCQB, and OTCQX

Key Findings:

- Post-COVID Decline: All four exchanges experienced a surge in trading activity during the COVID years (2020-2021), likely fueled by increased retail investor participation, government stimulus, and a general increase in speculative trading. However, 2022 and 2023 saw a significant decline in trading volume across the board, suggesting that the pandemic created an anomaly rather than a lasting shift.

- TSX Venture Exchange (TSX-V): The TSX-V, traditionally a dominant force in Canadian microcaps, has been particularly hard hit. Both trading volume and the number of listed companies have declined steadily since around 2018. The data supports the observation of a broader decline in interest in this market, extending beyond the COVID-related volatility.

- Canadian Securities Exchange (CSE) Growth: The CSE has emerged as a notable competitor to the TSX-V, particularly in attracting new listings, many of them in the cannabis and crypto sectors. While trading volume has also declined post-COVID, it remains relatively higher than pre-2020 levels, indicating that the CSE may have captured some market share.

- OTC Markets Volatility: The OTC Markets, especially the OTCQB, experienced extreme volatility during the COVID years, with a massive spike in dollar trading volume. While activity has since subsided, the OTCQB and OTCQX continue to be relevant markets for smaller US and international companies.

Possible Explanations for the Decline:

- Shifting Investor Sentiment: A “risk-off” environment may be pushing investors towards larger, more established companies.

- Rising Interest Rates: Higher interest rates make it more expensive for companies to raise capital and can reduce investor appetite for speculative investments.

- Inflationary Pressures: Inflation can negatively impact the growth prospects of smaller companies.

- Increased Regulatory Scrutiny: Enhanced scrutiny of microcap companies by regulators may be deterring some companies and investors.

- The Rise of Alternative Investments: The emergence of cryptocurrencies and other alternative investment opportunities may be drawing some investors away from microcaps, although these have also been extremely volatile.

- The Rise of Automated Trading: Algorithmic trading may be impacting liquidity patterns, making it more challenging for traditional investors.

Navigating the Changing Landscape:

The microcap market is undoubtedly evolving. While the data suggests a decline in overall interest, this doesn’t mean it’s the death of microcap investing. Rather, it highlights the need for investors to adapt to the changing landscape:

- Emphasis on Due Diligence: Thorough research and due diligence are more crucial than ever. Investors need to look beyond the hype and focus on companies with strong fundamentals, experienced management, and a clear path to profitability.

- Sector-Specific Opportunities: While the overall market may be facing headwinds, specific sectors will still offer attractive opportunities.

- Risk Management: Investors need to carefully manage their risk exposure, diversifying their portfolios and using appropriate position sizing.

Conclusion

The data suggests a decline in interest in microcap stocks in recent years, particularly on the TSX-V, although the CSE and OTC Markets in the United States have shown resilience. The COVID-19 pandemic created a period of unusual activity, but the underlying trend appears to be a shift away from the speculative fervor that once characterized these markets. While this may present challenges, it also creates opportunities for discerning investors who are willing to do their homework and focus on quality over hype. The microcap market remains a niche aspect of investing where fortunes can be made, but it requires a cautious, informed, and disciplined approach. The Medipharm example serves as a reminder that even seemingly positive news may not be enough to overcome broader market sentiment.

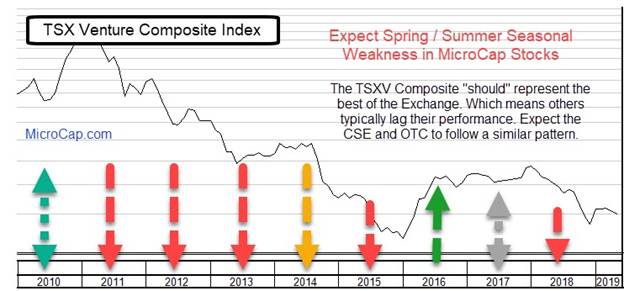

ADDENDUM – The TSX Venture Chart: Seasonal Weakness

The adage “sell in May and go away” is a well-known Wall Street axiom, suggesting that investors should sell their stock holdings in May and return to the market in November. While this strategy may have some merit in broader markets, the microcap sector often dances to its own tune. Experienced microcap investors have long observed distinct seasonal patterns that go beyond the simple “sell in May” maxim, with periods of weakness and strength that can significantly impact investment returns. This article will delve into the nuances of microcap seasonality, exploring the factors that contribute to these patterns and offering insights for investors seeking to navigate these cyclical swings.

The Early Sell-Off: April Showers Bring May (and June and July and August) Flowers (of Weakness)?

While the traditional “sell in May” adage suggests a May downturn, recent trends in the microcap market, particularly in Canada, indicate that the sell-off often begins earlier, in April. Several factors may contribute to this phenomenon:

- Anticipation of “Sell in May”: As the “sell in May” strategy has gained popularity, investors may be preemptively selling in April, attempting to get ahead of the anticipated May downturn. This creates a self-fulfilling prophecy, pushing the start of the weak period earlier.

- Tax-Related Selling: In many jurisdictions, including Canada and the United States, April is a significant month for income tax payments. Investors may sell a portion of their holdings to free up cash to meet their tax obligations, adding to the selling pressure.

- Spring/Summer Doldrums: As the weather improves, many investors shift their focus away from the markets and towards vacations and other leisure activities. This can lead to reduced trading volume and a general lack of interest in microcap stocks, particularly during July and August.

The TSX Venture Chart: Evidence of Seasonal Patterns

The provided chart of the TSX Venture Composite Index (TSX-V) provides visual evidence of these seasonal tendencies. Examining the period from 2010 to 2019, we can observe the following patterns:

- Consistent Spring/Summer Weakness: The chart shows a noticeable dip in the TSX-V index during the spring and summer months in most years. This supports the observation that the “sell in May” weakness often extends through the summer, with the weakest months being June, July and August.

- Early Year Strength: Conversely, the chart suggests that the early months of the year (January to March) often exhibit stronger performance. This could be attributed to renewed investor interest after the holiday season and tax loss selling ending on December 31st. Also “RRSP” season in Canada, when investors are encouraged to add to their retirement savings plans before the end of February each year.

- Fall Rebound: The index often experiences a rebound in the fall, typically starting in September or October. This coincides with investors returning from their summer breaks and actively seeking new opportunities.

The November/December Slump: Tax-Loss Selling and Holiday Distraction

Another period of weakness often observed in microcap stocks is November and early December. This can be attributed to:

- Tax-Loss Selling: Investors may sell underperforming stocks towards the end of the year to realize capital losses, which can offset capital gains and reduce their overall tax burden.

- Holiday Season: Similar to the summer, the holiday season can be a period of reduced trading activity as investors focus on personal matters and year-end planning. There also tends to be less financings or capital raises during this period.

Navigating the Seasonal Swings:

Understanding these seasonal patterns can provide microcap investors with an edge:

- Strategic Buying Opportunities: Periods of seasonal weakness, like late spring to late summer or November/December, may present attractive buying opportunities for long-term investors. These periods could result in overselling.

- Profit-Taking: Conversely, periods of seasonal strength, like the early months of the year and the fall, may be opportune times to take profits on well-performing stocks.

- Adjusting Expectations: Recognizing that microcap stocks may experience periods of quiet trading during the summer and holiday season can help investors manage their expectations and avoid making impulsive decisions.

- Focus on Fundamentals: While seasonality can provide a useful framework, it’s important to remember that a company’s underlying fundamentals should always be the primary driver of investment decisions.