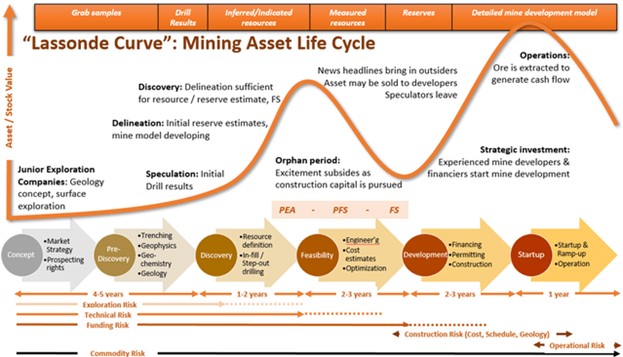

The junior mining sector, particularly exploration, is a high-risk, high-reward proposition. Companies are often built around the potential of a single discovery, and their stock prices can fluctuate dramatically based on exploration results, market sentiment, and a myriad of other factors. For investors seeking to navigate this volatile landscape, understanding the Lassonde Curve, a concept developed by legendary mining investor Pierre Lassonde, is essential. This graphical representation of a mining company’s typical life cycle provides a framework for understanding value creation, risk, and key milestones in the journey from grassroots exploration to a producing mine.

The Lassonde Curve: A Visual Roadmap of Value Creation and Risk

The Lassonde Curve illustrates the different stages of a mining project’s development and the corresponding changes in its theoretical value over time. While each project is unique, the curve highlights common phases and their associated risks and rewards:

1. Concept/Exploration Stage (High Risk, High Potential Reward):

- Characteristics: This initial phase involves generating exploration targets, acquiring land, and conducting early-stage exploration activities like geological mapping, geochemical sampling, and geophysical surveys.

- Value Drivers: Success hinges on identifying promising geological indicators and securing prospective land positions. Early discoveries, even minor ones, can generate significant excitement and share price appreciation.

- Risk: This is the riskiest stage. Most exploration projects do not result in an economic discovery. Companies are often pre-revenue and rely heavily on speculative capital.

- Investor Profile: Investors in this phase are typically risk-tolerant individuals or specialized funds with expertise in geology and exploration.

2. Discovery Stage (Highest Risk, Highest Potential Reward):

- Characteristics: Drilling commences, aimed at confirming the presence of a significant mineral deposit.

- Value Drivers: Positive drill results that indicate a potentially economic deposit can lead to a dramatic increase in the company’s valuation. This is often where the most substantial gains for investors are realized.

- Risk: Drilling is expensive and uncertain. Negative results can quickly decimate a company’s share price.

- Investor Profile: Similar to the exploration stage but may attract more investors due to tangible results.

3. Feasibility Stage (De-risking Phase):

- Characteristics: The company conducts detailed studies to determine the economic viability of the deposit. This includes:

- Preliminary Economic Assessment (PEA): An initial, high-level study of the project’s potential economic viability.

- Pre-Feasibility Study (PFS): A more detailed study with greater accuracy in cost estimations and project design.

- Bankable Feasibility Study (BFS): A comprehensive study that provides the highest level of confidence in the project’s economic viability, often required for securing project financing.

- Value Drivers: Positive feasibility studies reduce the project’s risk and increase investor confidence, potentially leading to a higher valuation. Permitting and environmental approvals are initiated during this stage.

- Risk: Studies may reveal that the project is not economically viable, or permitting may be problematic, leading to significant share price declines.

- Investor Profile: Attracts a broader range of investors as the project becomes more defined and risks are better understood.

4. Development/Construction Stage (Capital Intensive Phase):

- Characteristics: The company secures financing and begins construction of the mine and related infrastructure.

- Value Drivers: Progress on construction, on-time and on-budget performance, can positively impact the share price.

- Risk: This phase is capital-intensive, and cost overruns or construction delays are common. Financing can be challenging to secure.

- Investor Profile: May attract larger, more risk-averse investors as the project moves closer to production.

5. Production Stage (Cash Flow Generation):

- Characteristics: The mine begins operating, producing and selling the targeted mineral.

- Value Drivers: Revenue generation, profitability, and operating cash flow become the primary drivers of value.

- Risk: Operational challenges, fluctuating commodity prices, and mine life limitations can impact profitability.

- Investor Profile: Attracts investors seeking stable cash flows and dividends. The company is no longer considered a “junior” and is now a producer.

6. Closure and Reclamation:

- Characteristics: The mine eventually reaches the end of its productive life. The company is responsible for closing the mine and restoring the site to an acceptable environmental standard.

The Lassonde Curve’s Importance for Junior (Penny Stock) Mining Investors:

The Lassonde Curve is particularly relevant for investors in junior exploration and development companies because it:

- Provides a Framework for Assessing Risk and Reward: The curve helps investors understand that the risk/reward profile changes as a project progresses. The highest potential returns (and highest risks) are typically found in the early stages.

- Highlights Key Value Inflection Points: The curve identifies critical milestones, such as discovery, feasibility studies, and permitting, that can significantly impact a company’s valuation.

- Guides Investment Decisions: Investors can use the curve to align their investment strategies with the stage of development of a particular project. For example, investors seeking high-growth potential might focus on companies in the exploration or discovery phase, while those seeking lower risk might prefer companies closer to production.

- Emphasizes the Importance of De-risking: The curve visually demonstrates how value is created by successfully advancing a project through each stage and progressively reducing risk.

Conclusion

The Lassonde Curve is more than just a theoretical model; it’s a practical tool for understanding the life cycle of mining projects and making informed investment decisions in the junior mining sector. By understanding where a company sits on the curve and recognizing the risks and rewards associated with each stage, investors can better navigate the inherent volatility of microcap exploration stocks. While the allure of early-stage discoveries is undeniable, the Lassonde Curve reminds us that successful mining investments require a long-term perspective, a focus on de-risking, and a thorough understanding of the many challenges that lie on the path from exploration to production. It also helps investors realize that during the early stages of exploration and development, a company is burning through cash and needs investor support to advance.

ADDENDUM (Another Perspective – Stock Impact Specific)

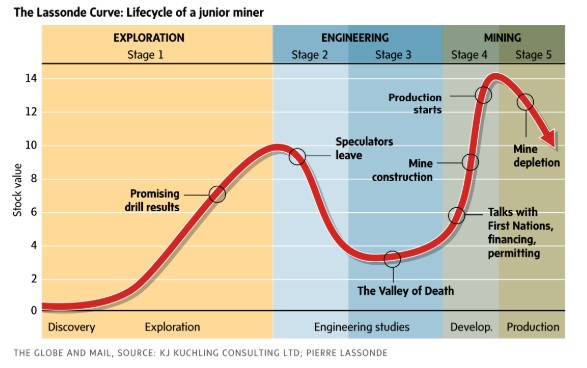

Exploration Phase: Hype and Hope

- This is where the “story” is often most compelling. Company executives and promoters highlight the potential of the property, emphasizing geological potential and blue-sky exploration targets.

- Drill results are eagerly anticipated, and positive news can lead to significant stock price increases. However, as you mentioned, these early results often fail to live up to the hype, leading to disappointment and stock price declines.

- Microcap investors need to be cautious during this phase, recognizing that exploration is inherently risky and most projects fail to find economically viable deposits.

Engineering Phase: The Valley of Death

- If a company does make a promising discovery, it enters the engineering phase, where studies and planning for mine development take place.

- This phase can be quite “boring” for investors, as there’s less news flow and the focus shifts to technical details and financing.

- The stock price often stagnates or declines during this period, as investors become impatient and move on to other opportunities.

- However, this phase is crucial for separating the wheat from the chaff. Companies that can successfully navigate the engineering and permitting process and secure financing for mine construction are more likely to create long-term value.

Mining Phase: Revaluation and Production

- Once a mine is in production, the company begins generating revenue and cash flow. This is when the company and the stock are often revalued, as investors recognize the actual value of the asset.

- However, even during the production phase, challenges can arise, such as operational issues, commodity price fluctuations, and mine depletion.

- Microcap investors who can identify companies with promising projects and have the patience to hold through the “Valley of Death” can potentially reap significant rewards during the production phase.

Key Takeaways for Microcap Investors

- Be wary of hype: Don’t get caught up in the excitement of early exploration results. Do your own research and focus on the fundamentals of the project.

- Understand the cycle: Recognize that junior mining stocks go through distinct phases, each with its own risks and opportunities.

- Be patient: Don’t expect overnight riches. Successful mining projects take time to develop, and the biggest rewards often come in the later stages.

- Manage risk: Diversify your portfolio and be prepared for setbacks. Not every promising exploration project will turn into a producing mine.

By understanding the lifecycle of a junior miner and the psychological factors that influence investor behavior, microcap investors can make more informed decisions and increase their chances of success.