Introduction

Mergers and acquisitions are often heralded as catalysts for growth and increased shareholder value. However, in the penny stocks space, these events can be a double-edged sword. While they may offer strategic benefits, they can also lead to significant downward pressure on a company’s stock price, particularly in the period following the transaction. This article will explore the challenges that microcap companies face after completing mergers or acquisitions, with a specific focus on the impact of lockup expirations, share issuance, and convertible debt. Furthermore, we will examine the often-overlooked importance of balance sheet analysis, particularly the risks associated with excessive goodwill and intangible assets, using an example from Exro Technologies (EXRO:TSX $0.13 – May 2025) to illustrate these risks.

The Promise and Peril of M&A for Penny Stocks

For penny stock / microcap companies, M&A can be a way to:

- Expand Market Reach: Gain access to new markets, customers, or technologies.

- Achieve Synergies: Combine complementary businesses to reduce costs, improve efficiency, and enhance product offerings.

- Increase Scale: Become a larger and potentially more competitive player in their industry.

- Boost Shareholder Value: A well-executed M&A can create value for shareholders through increased earnings, market share, and growth potential.

However, these transactions also come with risks:

- Integration Challenges: Combining two companies can be complex and challenging, requiring careful integration of operations, systems, and personnel.

- Overpayment: The acquirer may overpay for the target company, leading to a decline in shareholder value.

- Cultural Clashes: Differences in corporate culture can lead to conflicts and hinder the integration process.

- Dilution: M&A transactions often involve the issuance of new shares, which can dilute existing shareholders.

The Exro Technologies Example: A Case Study in Post-Merger Pressure and Balance Sheet Risks

Exro, a company that develops power electronics for electric motors, highlighted the challenges that can arise following a merger. In a November 2024 press release, the company attributed a more than 50% decline in its share price since late September to the following factors:

- Lockup Expiration: Exro had completed a merger with SEA Electric, and SEA shareholders received Exro shares with a six-month lockup period. The expiration of this lockup in early October unleashed a wave of selling pressure as these shareholders were finally able to liquidate their holdings.

- Weak Market Conditions: The broader market for electric vehicle (EV) related stocks was also experiencing weakness, exacerbating the selling pressure.

- Increased Trading Volume: The combination of the lockup expiration and negative market sentiment resulted in trading volumes more than three times the average daily levels.

A Closer Look at Exro’s Balance Sheet: The Perils of Goodwill and Intangibles

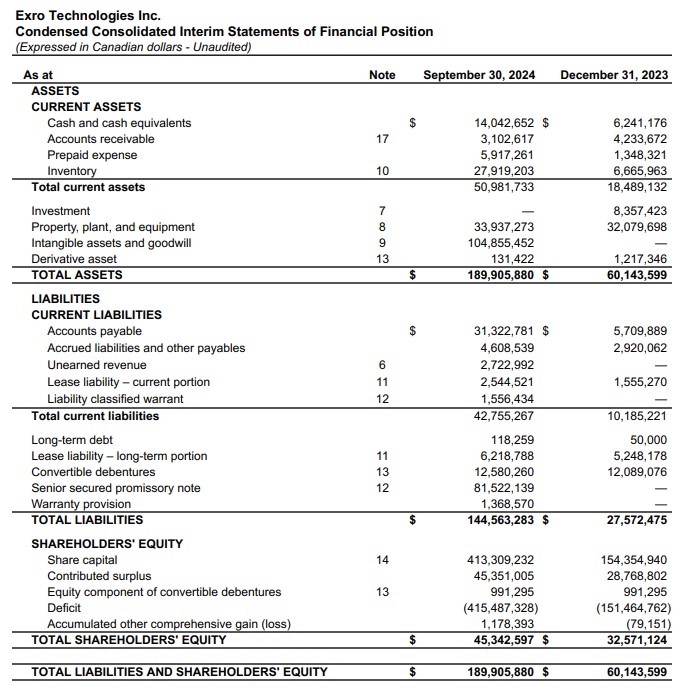

A glance at Exro’s most recent balance sheet, as of September 30, 2024, revealed cause for concern:

- Intangible Assets and Goodwill: A staggering $104,855,452 is recorded under this category. This represents a significant portion of the company’s total assets ($189,905,880). This raises the question of whether Exro significantly overpaid for SEA Electric.

- Total Liabilities: Exro had $144,563,283 in total liabilities, including a substantial $81.5 million promissory note.

- Shareholder Equity: Shareholder equity stood at only $45,342,597.

- Accounts Payable: $31,322,781 was very high relative to only $14,042,652 cash on hand.

The Cannabis Cautionary Tale: The situation with Exro’s balance sheet bears a resemblance to the acquisition spree that occurred in the Canadian cannabis industry between 2016 and 2019. Many cannabis companies made acquisitions at inflated valuations, resulting in massive goodwill and intangible asset write-downs when the anticipated synergies and growth failed to materialize. These write-downs often led to significant losses and shareholder dilution.”

The Risks of Excessive Goodwill and Intangibles:

- Overpayment: Goodwill and intangible assets often reflect the premium paid over the fair value of a company’s identifiable assets. A large amount of goodwill suggests that the acquirer may have overpaid, which can lead to future write-downs if the acquired business underperforms.

- Impairment Charges: Companies are required to periodically assess the value of their goodwill and intangible assets. If the value of these assets has declined, the company must record an impairment charge, which reduces earnings and can negatively impact the stock price.

- Lack of Tangible Value: Unlike tangible assets like property, plant, and equipment, goodwill and intangible assets are more difficult to value and may not be easily liquidated in case of financial distress.

The Mechanics of Lockup Expirations:

A lockup agreement is a legally binding contract that prevents certain shareholders (typically insiders or those who received shares in a merger or private placement) from selling their shares for a specified period.

- Purpose: Lockups are designed to prevent a sudden flood of shares onto the market, which could depress the stock price immediately after a merger, acquisition, or IPO.

- The Expiration Effect: When a lockup expires, the pent-up supply of shares can be released onto the market, often leading to increased selling pressure and a decline in the stock price. This is especially true if the stock has performed poorly since the shares were issued, or if the initial valuation was considered high.

Due Diligence: Looking Beyond the Headlines

When evaluating penny stocks, investors need to look beyond the headlines of a merger or acquisition and carefully examine the details of the transaction:

- Acquisition Currency: Was the deal primarily funded with stock, cash, or a mix? A stock-based acquisition will lead to immediate dilution, whereas a cash deal will not.

- Lockup Agreements: Were any lockup agreements put in place, and if so, when do they expire?

- Share Issuance: How many new shares were issued as part of the transaction, and how does this impact the company’s overall share structure?

- Convertible Debt: Does the company have any outstanding convertible debt, and what are the terms of conversion?

- Valuation: Was the acquisition done at a fair valuation, or did the company overpay? Examine the amount of goodwill and intangible assets recorded on the balance sheet.

Conclusion

Mergers and acquisitions can be transformative events for microcap companies, but they also present significant risks for investors. The Exro Technologies example serves as a stark reminder that lockup expirations, particularly when combined with broader market weakness and a questionable balance sheet, can exert considerable downward pressure on a stock’s price. Furthermore, the large amount of goodwill and intangible assets on Exro’s balance sheet raised concerns about potential overpayment and future impairment charges. By understanding the mechanics of M&A transactions, paying close attention to share issuance, lockup agreements, convertible debt, and carefully scrutinizing the balance sheet, investors can better assess the potential risks and rewards of these events. In the microcap world, a healthy dose of skepticism and a commitment to thorough due diligence are essential for making informed investment decisions and avoiding the post-merger blues. The cannabis industry serves as a cautionary tale, reminding us that even in seemingly “hot” sectors, overpaying for acquisitions can have devastating consequences.