The microcap market, while offering the tantalizing prospect of high-growth opportunities, unfortunately also attracts those seeking to exploit unsuspecting investors. Among the most prevalent tactics employed are aggressive stock promotion and the insidious “pump-and-dump” scheme. These manipulative practices aim to artificially inflate a stock’s price through misleading or outright false information, ultimately separating investors from their hard-earned money. Understanding the mechanics of these schemes, recognizing the warning signs, and adopting a vigilant approach are crucial for anyone venturing into the microcap arena.

Why Microcaps are Prime Targets for Manipulation:

Several inherent characteristics of the microcap market make it particularly vulnerable to stock promotion and pump-and-dump tactics:

- Low Trading Volume and Liquidity: Microcap stocks often trade with relatively low volumes, meaning it takes a smaller amount of buying pressure, often orchestrated by promoters, to significantly influence the stock price. This lack of liquidity also makes it difficult for investors to exit their positions without causing the price to plummet once the promotion ends.

- Information Asymmetry and Scarcity: Many microcap companies lack extensive analyst coverage, and reliable information about their operations, financials, and future prospects can be scarce. This information vacuum creates an opportunity for promoters to fill the void with biased and often misleading narratives.

- Less Stringent Regulation and Enforcement Challenges: While regulations do exist to prevent market manipulation, the sheer number of microcap companies and the limited resources of regulatory bodies can make consistent and effective enforcement a significant challenge. This allows some bad actors to operate with a perceived lower risk of detection and prosecution.

- Investor Psychology and the Allure of Quick Riches: The promise of rapid and substantial returns, coupled with the “fear of missing out” (FOMO) on the next big thing, can make investors in the microcap market more susceptible to hype and less inclined to conduct thorough due diligence. This emotional vulnerability is a key target for stock promoters.

The Anatomy of Stock Promotion: Painting a Rosy (and Often False) Picture:

Stock promotion involves disseminating information, often through paid channels, with the goal of increasing investor interest and driving up the price of a particular stock. While legitimate investor relations efforts exist, aggressive stock promotion crosses the line into manipulation when the information presented is misleading, exaggerated, or outright false. Common methods include:

- “Tout Sheets” and Investment Newsletters: These publications, often disguised as independent investment research, issue glowing recommendations and predict unrealistic price targets, sometimes even featuring endorsements from seemingly credible sources or celebrities. The undisclosed compensation behind these “recommendations” is a major concern.

- Email and Text Message Blasts: Unsolicited emails and text messages are used to reach a broad audience, creating a sense of urgency and excitement around a specific stock, often promising imminent and substantial gains.

- Social Media Hype and Online Forums: Promoters leverage social media platforms like Twitter, StockTwits, Stockhouse, and various online forums to spread rumors, create buzz, and attract unsuspecting investors. This can involve coordinated campaigns using multiple accounts and the strategic dissemination of positive (but often unsubstantiated) information.

- Paid Influencers: Individuals with large followings on social media or within specific investment communities may be paid to promote a stock, often without clearly disclosing their compensation, leading their followers to believe their endorsement is genuine and unbiased.

- Website and Content Marketing: Companies or promoters may create elaborate websites and produce content (articles, videos, podcasts) that heavily promotes the stock, often focusing on a compelling “story” rather than verifiable facts and financial data.

The Pump-and-Dump: A Classic Con in Action:

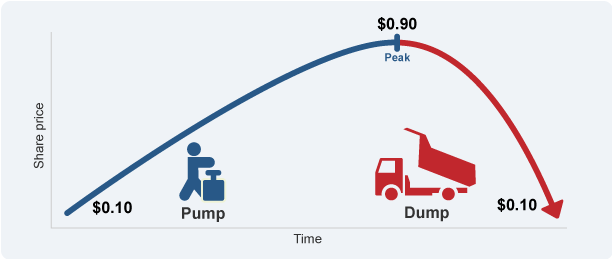

Stock promotion often serves as the engine for a “pump-and-dump” scheme, a time-tested tactic of market manipulation:

- Target Selection and Accumulation: Scammers identify a thinly traded microcap stock with a low share price. They then quietly accumulate a significant position in the company’s shares at these low prices, often through nominee accounts or offshore entities to conceal their ownership.

- The “Pump”: Once they have amassed their stake, the promoters initiate an aggressive promotional campaign using the methods described above. The goal is to create hype and generate significant buying pressure, driving the stock price up rapidly.

- The “Dump”: As the stock price rises due to the influx of new, often ill-informed investors, the insiders and promoters begin to sell off their shares at the artificially inflated prices. This selling pressure eventually overwhelms the buying interest, and the stock price begins to plummet.

- The Aftermath: The promoters and insiders walk away with substantial profits, while the investors who bought in at the higher prices are left holding worthless or significantly devalued shares.

Recognizing the Red Flags: Warning Signs of Manipulation:

Being able to identify the telltale signs of stock promotion and potential pump-and-dump schemes is crucial for protecting your capital:

- Unsolicited Stock Tips: Be extremely wary of unsolicited emails, text messages, or social media messages promoting a particular stock, especially if they urge you to buy immediately.

- Exaggerated Claims and Unrealistic Projections: Promises of guaranteed returns, revolutionary technologies with no evidence, or imminent breakthroughs that lack credible support should be treated with extreme skepticism.

- Pressure to Buy Immediately (“Don’t Miss Out!”): Promoters often create a false sense of urgency, urging investors to buy now before they miss the “opportunity of a lifetime.” Legitimate investment opportunities rarely require such high-pressure tactics.

- Lack of Transparency and Opaque Information: Be suspicious of companies that are not transparent about their business operations, financial performance, management team, or the compensation they pay to promoters.

- Vague or Boilerplate Disclosures: While companies engaging in legitimate promotion should disclose their relationships with third-party providers, be wary of disclosures that are buried in fine print or use vague language to minimize the significance of the paid promotion.

- Sudden and Unexplained Price Spikes: Be cautious of stocks that experience rapid and significant price increases without any corresponding positive news or fundamental developments. This is often a hallmark of a “pump.”

- Focus on “Story” Over Substance: Be wary of companies that heavily emphasize a compelling narrative or “story” while lacking solid financial fundamentals, a clear business model, or a proven track record.

- High Trading Volume Without Fundamental Justification: An unexpected surge in trading volume, particularly when accompanied by aggressive promotion, can be a sign of manipulative activity.

- Offshore Accounts and Hidden Ownership: Opaque ownership structures or the use of offshore accounts can be red flags, making it difficult to track who is truly behind the company and potentially involved in manipulation.

Company Defenses: Often a Smokescreen:

When questioned about promotional activities, companies may offer defenses that sound plausible but often fail to address the core issues:

- “We Properly Disclosed”: While disclosure of promotional agreements is legally required in many jurisdictions, these disclosures are often buried in obscure filings or worded in a way that downplays the extent and potential impact of the promotion.

- “The Information Was Accurate”: Companies might argue that the promotional materials were based on publicly available information and reviewed for accuracy. However, even if technically accurate, the information can be selectively presented and hyped to create a misleadingly positive impression.

- “No Insider Trading Occurred”: Denials of insider trading do not negate the fact that the promotional activity itself may have been manipulative and designed to artificially inflate the stock price for the benefit of insiders.

- Listing All Third-Party Providers: Under regulatory pressure, a company might disclose a broad list of marketing and investor relations firms they’ve engaged. This can be an indirect admission of past promotional activities, but it doesn’t necessarily absolve them of responsibility for misleading campaigns.

Protecting Yourself: Your Best Defense is Diligence and Skepticism:

The most effective way to avoid becoming a victim of stock promotion and pump-and-dump schemes is to adopt a proactive and skeptical approach to microcap investing:

- Be Inherently Skeptical: Never take any investment recommendation at face value, especially if it originates from an unsolicited source or a publication you are not familiar with and trust.

- Conduct Thorough Due Diligence: Before investing in any microcap company, conduct your own independent and thorough research. Don’t rely solely on information provided by the company or promoters.

- Verify Information from Independent Sources: Cross-reference any claims made by promoters with reliable and independent sources, such as regulatory filings (SEC’s EDGAR or SEDAR in Canada), reputable financial news outlets, and industry research reports.

- Focus on Fundamental Analysis: Analyze the company’s financial statements, management team, business model, competitive landscape, and long-term prospects. Don’t be swayed by hype or empty promises.

- Understand the Inherent Risks: Recognize that investing in the microcap market is inherently risky, and stock promotion is a common tactic used to amplify these risks for manipulative purposes.

- Avoid Herd Mentality and FOMO: Don’t get caught up in market hype or blindly follow the crowd. Make your own investment decisions based on your own research and analysis, not on fear of missing out.

- Use Limit Orders: When buying or selling microcap stocks, consider using limit orders to control the price at which your trades are executed, rather than relying on market orders which can be vulnerable to manipulation.

- Diversify Your Investments: Don’t put all your investment capital into a single microcap stock. Diversifying across multiple companies and sectors can help mitigate the risk of significant losses from any one investment.

- Report Suspicious Activity: If you suspect that you have encountered a pump-and-dump scheme or other form of market manipulation, report it to the appropriate regulatory authorities in your jurisdiction.

Conclusion: Vigilance is the Price of Protection in the Microcap World:

Aggressive or excessive stock promotion and the insidious pump-and-dump scheme remain persistent threats in the microcap market, preying on investor enthusiasm and exploiting the information gaps that often exist. By understanding the mechanics of these manipulative tactics, diligently recognizing the red flags, and prioritizing thorough due diligence grounded in fundamental analysis, investors can significantly enhance their ability to protect themselves from becoming the next victim. Remember, in the world of microcap investing, a healthy dose of skepticism, a commitment to independent research, and a refusal to be swayed by unrealistic promises are your most powerful allies. If an investment opportunity sounds too good to be true, it almost certainly is.