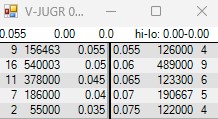

In the world of microcap investing, having access to real-time market data can (at times) be crucial. While charts and news releases provide valuable information, Level 2 market depth offers a more granular view of a stock’s supply and demand dynamics. This article will use a January 20, 2025 pre-market snapshot of Juggernaut Exploration (V-JUGR) on the TSX Venture Exchange to illustrate how to interpret Level 2 data and how it can be used to inform trading decisions in the microcap space.

Understanding Level 2 Market Depth

Level 2 market depth, also known as the “order book,” displays the bid (buy) and ask (sell) orders for a particular stock at various price levels. Unlike Level 1 quotes, which only show the best bid and ask prices, Level 2 provides a more comprehensive picture of the buying and selling interest at different price points.

- Bid Side (Left): Shows the orders to buy the stock, ranked from highest price to lowest.

- Ask Side (Right): Shows the orders to sell the stock, ranked from lowest price to highest.

- Volume: Indicates the number of shares that buyers or sellers are willing to transact at each price level.

- Orders: Shows the number of distinct orders at each price level.

Analyzing the Juggernaut Exploration (V-JUGR) Order Book

Let’s examine the pre-market Level 2 data for Juggernaut Exploration (V-JUGR) provided earlier:

Key Observations:

- Support at $0.045 and $0.05: The order book reveals significant buying interest at $0.045 (378,000 shares across 11 orders) and $0.05 (540,003 shares across 16 orders). These levels represent near-term support, suggesting that the price may be less likely to fall below these points in the immediate future.

- Resistance at $0.06: A large block of shares (489,000 shares across 9 orders) is offered for sale at $0.06, creating a resistance level. This indicates that the price may struggle to break above $0.06 without substantial buying pressure.

- Thinly Traded: The relatively low number of orders and shares at each price level confirms that JUGR is thinly traded. This means that even moderately sized orders can significantly impact the price.

- Potential for Volatility: The combination of thin trading and a noticeable spread between the bid and ask prices suggests that the stock could be volatile.

Interpreting the Data in Context:

Based on this Level 2 data, a trader might make the following observations:

- Buying Opportunity Near Support: The strong support at $0.045 and $0.05 could present a potential buying opportunity for investors who are bullish on the stock.

- Challenge at Resistance: The resistance at $0.06 suggests that the stock may face selling pressure if it approaches that level.

- Cautious Approach: The thin trading and potential for volatility warrant a cautious approach.

- Using Limit Orders: Given the illiquidity, using limit orders instead of market orders is strongly recommended to avoid unfavorable execution prices.

Limitations of Level 2 Data:

- Snapshot in Time: Level 2 data is dynamic and constantly changing. The order book can look very different once the market opens.

- Hidden Orders: Some traders use hidden or iceberg orders, which are not fully displayed in the order book, potentially masking the true supply or demand.

- Not a Crystal Ball: Level 2 data should not be used in isolation. It should be combined with other forms of analysis, including fundamental research and chart patterns.

Conclusion

Level 2 market depth provides a valuable window into the supply and demand dynamics of a stock, particularly in the microcap space where liquidity can be limited. By understanding how to interpret the order book, investors can gain a better sense of support and resistance levels, identify potential trading opportunities, and make more informed decisions. However, it’s crucial to remember that Level 2 market depth is just one piece of the puzzle. Combining this information with thorough due diligence, a sound investment strategy, and a healthy dose of skepticism is essential for navigating the unpredictable world of microcap stocks. The example of Juggernaut Exploration highlights how Level 2 data can inform trading decisions, but it also underscores the importance of using this information responsibly and in conjunction with other research methods.

ADDENDUM – JUGR at Market Open

Key Observations and Analysis:

- Sudden Increase in Resistance: When the market was ready to open, the amount of stock for sale at 6 cents went from around 500,000 to 1.5 million – representing a tripling of the resistance at that key price level. This is a very significant change and a major red flag.

- “Wall of Resistance”: This large block of shares for sale created a “wall” that will be very difficult for the stock price to break through. It signals that a large seller (or multiple sellers) were looking to exit at that price, for whatever reason.

- Source of the Shares: The sudden appearance of such a large sell order raises questions about its origin. It could be:

- Insiders or a Control Group: Individuals with inside knowledge or close ties to the company might be looking to sell a large position.

- Warrant Overhang: Warrants from past financings could be a source of selling pressure.

- Profit-Taking: Early investors who bought at lower prices might be taking profits after the recent run-up.

- Short Sellers: While less likely at this price level, it is possible short sellers are adding to positions.

Why A Decision To Terminate a Purchase Was Likely Prudent:

- Increased Risk: The significantly increased resistance at $0.06 dramatically increased the risk of buying the stock. The likelihood of the price breaking through that level in the short term was greatly reduced.

- High Volatility: The large sell order, combined with the stock’s thin trading, suggests that the stock will likely be very volatile, with potential for sharp price swings in either direction. Based on the limited upside (due to resistance) but significant downside, the risk/reward is not favorable.

- Long Runway for the Company: Juggernaut’s long and challenging path to potentially developing a remote project further reinforces the need for caution.

- Better Opportunities: Given the risks, a decision to wait and see, and potentially revisit the stock later, is a wise one.

This situation with JUGR perfectly illustrates several key principles:

- The Importance of Level 2 Data: The sudden change in the order book highlights the value of monitoring market depth in real time.

- The Risks of Illiquid Microcaps: The thin trading in JUGR makes it vulnerable to large orders having a disproportionate impact on the price.

- The Need for Caution: The combination of a remote project, a recent promotional surge, and a massive sell order at a key price level all point to the need for extreme caution.