The microcap market is known for its volatility and potential for rapid gains and losses. A key factor contributing to this dynamism is “herd mentality,” where investors, influenced by fear of missing out (FOMO) or the allure of quick profits, invest in a stock en masse, often without a thorough understanding of its fundamentals. The December 2024 surge in BTQ Technologies (BTQ:CSE) provides a compelling example of this phenomenon.

BTQ Technologies, operating in the niche area of post-quantum cryptography, experienced a dramatic increase in its stock price following Google’s announcement of a quantum chip breakthrough. This news sparked concerns about the vulnerability of existing encryption methods, leading investors to seek out companies specializing in quantum-resistant solutions. BTQ, with its focus on post-quantum cryptography, became a focal point of this interest.

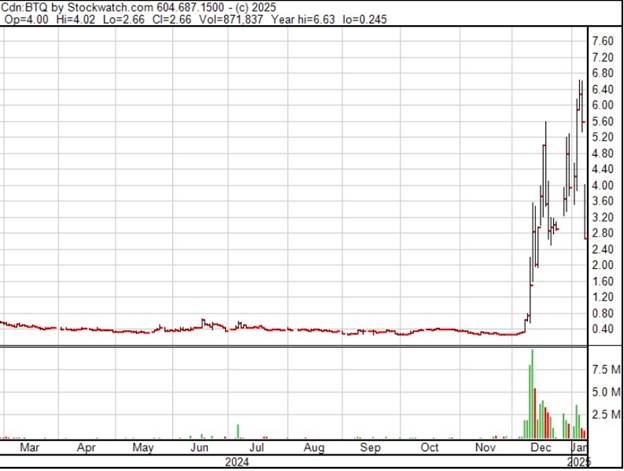

As investor attention grew, a classic case of herd mentality emerged. Driven by excitement and speculation, investors rushed to purchase BTQ stock, causing its valuation to skyrocket from approximately $25 million in November to nearly $300 million within a short period. This rapid ascent was primarily fueled by FOMO and the appeal of a trending sector, rather than a deep analysis of the company’s financial health.

It’s important to note that BTQ, despite its promising technology, remains a microcap company with limited revenue, significant cash burn, and inherent uncertainties. The surge in its stock price was largely driven by speculative trading, creating substantial gains for early investors but exposing those who joined the frenzy later to significant risk.

Key Takeaways for Penny Stock / Microcap Investors:

- Recognize Herd Mentality: Understand that emotions and social dynamics can significantly impact stock prices, particularly in the penny stock market.

- Conduct Thorough Research: Don’t rely solely on market hype. Perform due diligence and evaluate a company’s fundamentals before investing.

- Focus on Valuation: Develop a realistic understanding of valuation and avoid chasing stocks that have already experienced parabolic price increases.

- Manage Risk Effectively: Microcap investing is inherently risky. Implement a robust risk management strategy and be prepared for market fluctuations.

- Avoid Blind Momentum Chasing: While capitalizing on early momentum can be profitable, it’s crucial to assess the long-term sustainability of the trend and the underlying reasons behind the price movement.

The microcap market is often characterized by dramatic price swings, fueled by speculation, hype, and the ever-present hope of striking it rich. The above chart of BTQ on the Canadian Securities Exchange (CSE) provides a stark illustration of this phenomenon, showcasing a rapid ascent followed by an equally swift collapse. This article will analyze the BTQ chart, examining the factors that likely contributed to its volatility, including the recent reality check from Nvidia’s CEO on the timeline for quantum computing, and drawing key lessons for investors navigating the treacherous waters of penny stock investing.

BTQ’s Meteoric Rise: Riding the Wave of Quantum Computing Hype

The BTQ chart depicts a classic “hype cycle” scenario. From a base of around $0.40 in late 2023, the stock embarked on a meteoric rise in late December and early January, briefly touching highs over $6.00. This surge coincides with increased interest in quantum computing, triggered by news from Google about their quantum computing chip. The market was ablaze with speculation about the transformative potential of quantum computing, and BTQ, as a publicly-traded company with some connection to the sector, became a target for this speculative fervor.

The Inevitable Collapse: When Reality Bites – The Nvidia Factor

As is often the case with such rapid ascents in the microcap space, BTQ’s rise was followed by an equally dramatic collapse. The stock price plummeted, wiping out most of the gains and leaving many investors with substantial losses. Adding fuel to the fire, Nvidia’s CEO, Jensen Huang, recently injected a dose of reality into the quantum computing hype. At the CES conference on January 8th 2025, Huang commented that a 15-year timeframe for “very useful quantum computers” would “probably be on the early side.” This downbeat assessment, coming from a leading figure in the tech industry, sent shockwaves through the sector, causing a sharp sell-off in many quantum-themed stocks, including BTQ.

Likely Factors Contributing to the Collapse:

- Lack of Fundamentals: As mentioned in our previous discussions, BTQ reportedly has little to no revenue, a weak balance sheet, and a high monthly burn rate. The surge in its stock price was driven by speculation and hype surrounding the quantum computing sector, rather than by any underlying improvement in the company’s fundamentals.

- Profit-Taking: Investors who bought in early likely took profits as the stock price soared, adding to the selling pressure.

- Short Selling: Short sellers may have targeted BTQ, betting that the inflated stock price would eventually fall. This could have accelerated the decline. There may have also been short selling by holders of convertible debt.

- Bursting of the Bubble: The Nvidia CEO’s comments served as a pinprick to the speculative bubble, reminding investors that commercially viable quantum computing is still a long way off. This triggered a mass exodus from BTQ and other related stocks, as the hype evaporated.

Lessons Learned from the BTQ Chart:

The BTQ chart serves as a cautionary tale for penny stock investors, highlighting several important lessons:

- Beware of Hype Cycles: Be extremely cautious of stocks that experience sudden, parabolic price increases, especially when those increases are driven by hype surrounding a particular sector or technology. Be wary of buzzwords.

- Fundamentals Matter: Always research a company’s fundamentals (revenue, earnings, cash flow, debt, etc.) before investing, even in speculative situations. Don’t get caught up in the excitement and overlook the basics.

- Due Diligence is Essential: Thoroughly investigate the company’s management team, business model, and competitive landscape. Look for red flags, such as excessive promotion, a history of losses, and a lack of transparency.

- Don’t Chase Momentum Blindly: Chasing a rapidly rising stock without understanding the underlying reasons for the move is a recipe for disaster.

- Have an Exit Strategy: If you do decide to speculate on a high-flying microcap, have a clear exit strategy in place. Know when you’ll take profits and when you’ll cut your losses.

- Be Skeptical of Timelines: Be wary of overly optimistic timelines for emerging technologies. As Nvidia’s CEO pointed out, transformative technologies like quantum computing often take longer to mature than initially anticipated.

Conclusion

The BTQ chart is a stark reminder of the risks inherent in the microcap market, particularly when speculation and hype run rampant. While the allure of quick riches can be tempting, investors must prioritize fundamental analysis, conduct thorough due diligence, and approach these situations with a healthy dose of skepticism. Remember, if a stock’s rise seems too good to be true, it probably is. In the world of penny stocks, the most exciting stories will often end in disappointment, and true value often lies in the overlooked and underappreciated companies that are quietly building solid businesses.