In 2024, crypto is creating bubbles in the microcap space while NASDAQ is being fueled by big tech. Predicting market bubbles is notoriously difficult. The line between a justified bull market and an unsustainable bubble can be blurry. Even the smartest investors can make mistakes either predicting a bubble that doesn’t materialize or missing one that seems obvious in hindsight.

The Psychology of Bubbles:

Stock market bubbles are driven by human emotions like fear, greed, and the “fear of missing out” (FOMO) – that is a BIG one. These emotions can cloud judgment and lead to irrational investment decisions, driving prices far beyond what fundamentals can justify.

Current Market Conditions:

In 2024 there are realistic concerns about the valuations on NASDAQ. Examples include Nvidia, Broadcom’s surge after its CEO’s comments on AI, Tesla’s rapid price increase, and the frenzy around MicroStrategy and Bitcoin-related ETFs. These examples highlight the potential for overvaluation and speculative behavior in certain sectors.

Caution and Humility:

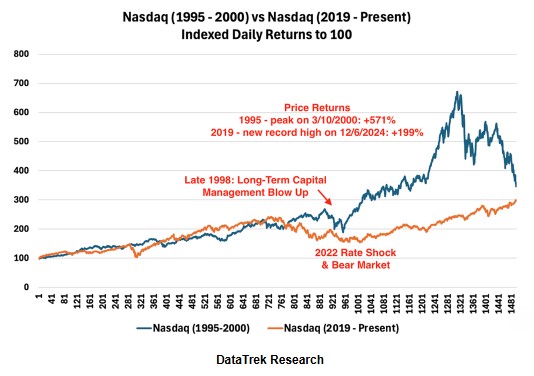

Even when it’s difficult to definitively declare a bubble, investors need to error on the side of caution when a rally has been underway. Market manias can persist for a surprisingly long time, but they inevitably end, often with painful consequences for those caught up in the hype. Clear proof of this was the tech / internet run in 1999/2000 (reference the chart above).

Applying These Insights to Microcaps:

The microcap market, with its inherent volatility and speculative nature, can be even more prone to bubbles than larger-cap markets. Here’s how these insights apply to microcap investing:

- Heightened Awareness: Be extra vigilant for signs of irrational exuberance and hype in the microcap space. Just because a company is associated with a hot trend like AI or crypto doesn’t automatically justify its valuation.

- Focus on Fundamentals: Don’t get swept up in the excitement. Always conduct thorough due diligence, scrutinize a company’s financials, and assess its long-term prospects.

- Beware of Herd Mentality: Don’t blindly follow the crowd. Make independent investment decisions based on your own research and risk tolerance.

- Manage Risk: Be prepared for volatility and potential losses. Don’t invest more than you can afford to lose, and consider diversifying your portfolio to mitigate risk.

Greed and emotions are typically the psychological drivers of bubbles. While it’s impossible to predict the future with certainty, recognizing the signs of overvaluation and speculative behavior can help investors make more informed decisions.

In the microcap world, it’s especially important to maintain a disciplined approach, focus on fundamentals, and avoid chasing hype. Remember, even the most promising trends and technologies can lead to bubbles if investors get carried away by emotions and speculation.

I’m reminded of Warren Buffett‘s wise words: “I know what will happen. I just don’t know when.” While we can’t predict the exact timing of market corrections, we can prepare for them by staying informed, managing risk, and making rational investment decisions.

RECOMMENDED BOOKS

I’ve analyzed reviews from both Google and Amazon to compile a list of ten books that delve into the psychology of crowds, irrational exuberance in investing, and herd mentality. These books offer valuable insights into the emotional and social forces that can drive market bubbles and influence investor behavior.

1. Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay

This classic work, originally published in 1841, explores historical examples of crowd psychology and market manias, including the South Sea Bubble, the Tulip Mania, and the Salem Witch Trials.

2. Irrational Exuberance by Robert Shiller

Nobel laureate Robert Shiller examines the psychological and structural factors that contribute to market bubbles, drawing on historical data and behavioral economics.

3. The Black Swan by Nassim Nicholas Taleb

This book explores the impact of highly improbable events (“black swans”) on financial markets and human behavior, challenging traditional risk management models.

4. Thinking, Fast and Slow by Daniel Kahneman

Nobel laureate Daniel Kahneman explores the two systems of thinking that drive human behavior: the fast, intuitive System 1 and the slow, deliberate System 2.

5. Predictably Irrational by Dan Ariely

Behavioral economist Dan Ariely explores the systematic ways in which humans deviate from rationality, with implications for decision-making in investing and other areas.

6. The Art of Thinking Clearly by Rolf Dobelli

This book explores common cognitive biases and errors that can lead to flawed thinking and decision-making, including in financial markets.

7. Misbehaving by Richard Thaler

Nobel laureate Richard Thaler recounts the development of behavioral economics and its implications for understanding human behavior in financial markets.

8. The Psychology of Money by Morgan Housel

This book explores the psychological factors that drive financial decision-making, including risk aversion, greed, and the influence of social comparison.

9. Influence by Robert Cialdini

This classic work explores the principles of persuasion and how they can be used to influence behavior, including in investment settings.

10. Nudge by Richard Thaler and Cass Sunstein

This book explores how subtle changes in the way choices are presented (“nudges”) can influence behavior, with implications for promoting better investment decisions.

_____________________________________

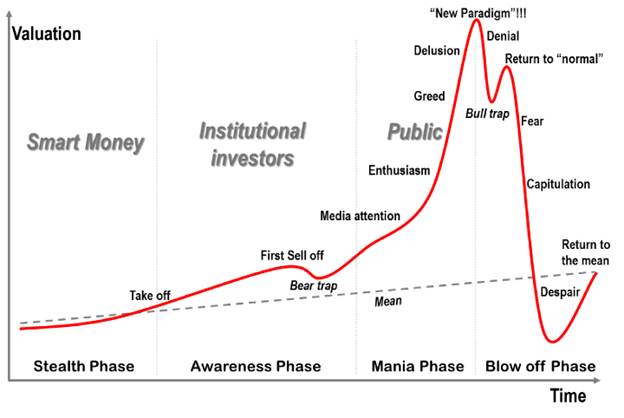

THE PSYCHOLOGY BEHIND MARKET CYCLES

Understanding the Chart

The chart above depicts the emotional and financial journey investors often experience during market cycles, particularly those driven by speculation and hype. It highlights how emotions and crowd psychology can influence investment decisions and lead to irrational behavior.

Key Stages

- Stealth Phase: Early stage where smart money starts accumulating undervalued assets.

- Awareness Phase: More investors become aware of the opportunity, and prices begin to rise.

- Mania Phase: Hype and speculation drive prices to unsustainable levels. Greed and FOMO take over.

- Blow-off Phase: The bubble bursts, and prices crash dramatically. Panic selling ensues.

Key Takeaways

- Be aware of your emotions: Don’t let fear or greed dictate your investment decisions.

- Stay disciplined: Stick to your investment plan and avoid chasing hype or momentum.

- Focus on value: Look for undervalued assets with strong fundamentals.

- Manage risk: Use risk management strategies to protect your capital during market downturns.

By understanding the dynamics of market cycles and the psychology of investing, microcap investors can make more informed decisions and avoid being caught up in speculative bubbles.

Side Note: Since the covid pandemic (2020), many new investors with easy access to cash (federal aid / financial support) and cheap commission trading apps, have been caught up in the “Mania Phase” of speculative bubbles in tech stocks and cryptocurrencies. They are driven by FOMO and the allure of quick riches, often ignoring fundamental valuations and risk management.