Introduction

Exploitative financing arrangements, such as those involving toxic convertible debt or warrants issued via private placements, can directly facilitate market manipulation by providing fraudsters with a supply of cheap shares needed for the eventual “dump” phase of a pump-and-dump scheme. Understanding the mechanics of both predatory financing and market manipulation, recognizing the tactics employed, being aware of regulatory efforts, and knowing how to identify red flags are critical for anyone navigating the penny stocks space.

Understanding Convertible Debt in Penny Stocks: A Double-Edged Sword

A. Definition and Mechanics

Convertible debt, also known as a convertible debenture, is a hybrid financial instrument that combines features of both debt and equity. It functions initially as a loan, requiring the issuing company to make regular interest (coupon) payments and repay the principal amount at a specified maturity date, assuming the debt has not been converted. However, it also grants the debt holder the option to convert the debt into a predetermined number of the company’s common shares at a specified conversion price. This conversion feature offers the debt holder potential upside participation in the company’s equity appreciation if the stock price rises above the conversion price.

B. Why Penny Stocks Use Convertible Debt

Microcap companies often utilize convertible debt financing for several strategic reasons. It can provide access to capital, particularly when traditional bank loans are unavailable or when equity market conditions are unfavorable for a direct stock offering, perhaps due to a low prevailing share price or a limited operating history. Compared to straight debt, convertible debt may carry a lower interest rate because the conversion option provides additional potential value to the lender. Furthermore, issuing convertible debt allows companies to delay the immediate shareholder dilution that would occur with a direct equity offering, pushing that potential dilution into the future.

C. Inherent Risks for Investors (Even with Standard Convertible Debt)

While convertible debt can be a useful tool for companies, it introduces specific risks for existing equity investors, even when the terms are standard (i.e., non-toxic):

- Dilution Risk: The most direct risk is dilution. When debt holders exercise their option to convert, the total number of outstanding shares increases. This reduces the ownership percentage of existing shareholders and can exert downward pressure on the stock price due to the increased supply of shares.

- Conversion Price Overhang: The existence of a fixed conversion price can create a psychological barrier or “overhang” in the market. As the company’s stock price approaches the conversion price, investors may anticipate that debt holders will soon convert and potentially sell their newly acquired shares. This expectation of future selling pressure can dampen enthusiasm for the stock and act as a ceiling, preventing further price appreciation even in the absence of negative news.

- Interest Rate Risk: Like traditional bonds, the value of the debt component of a convertible security is sensitive to changes in prevailing interest rates. If market interest rates rise significantly after the convertible debt is issued, the fixed coupon payments become less attractive, potentially decreasing the market value of the debenture.

- Default Risk: As with any debt instrument, there is a risk that the issuing company’s financial condition could deteriorate to the point where it is unable to make the required interest payments or repay the principal amount at maturity. In such a scenario, both debt holders and equity holders could face significant losses.

The presence of standard convertible debt, therefore, necessitates careful consideration by investors. Even without predatory terms, it introduces complexities and potential market dynamics that differ from simple equity ownership. The sheer volume of potential shares represented by the convertible debt (the “overhang”), the proximity of the current stock price to the conversion price, and the approaching maturity date can all influence investor sentiment and trading behavior. Debt holders might also engage in short selling the underlying stock as a hedge against their convertible position, adding further downward pressure irrespective of the company’s fundamental performance. Consequently, a thorough analysis of the amount of convertible debt outstanding relative to the company’s market capitalization, the specific conversion terms, the maturity profile, and the company’s overall financial health is essential for assessing the associated risks.

The Death Spiral: When Financing Turns Toxic

A. Defining “Death Spiral” or “Toxic Convertible Debt”

While standard convertible debt carries inherent risks, a far more dangerous variant exists, commonly known as “death spiral” financing, “toxic convertible debt,” or “floorless convertible debt”. The defining and most pernicious feature of this type of financing is its conversion price mechanism. Instead of being fixed at the time of issuance, the conversion price is variable and adjusts downward based on the future market price of the company’s stock. Typically, the conversion price is set at a significant discount to the prevailing market price at the time of conversion, often calculated based on the lowest trading prices over a recent look-back period (e.g., 80% of the lowest volume-weighted average price over the previous 10 or 20 trading days). This floating, discounted conversion price is the key element that transforms the financing from a capital-raising tool into a potentially company-destroying mechanism.

B. The Mechanics of Destruction: A Vicious Cycle

The structure of death spiral financing creates a destructive feedback loop that benefits the lender at the direct expense of the company and its existing shareholders:

- The Initial Deal: The process typically begins when a microcap company, often in dire financial straits and unable to secure funding through conventional means (bank loans, traditional equity offerings), accepts financing from a specialized lender. These lenders are sometimes referred to as “vulture” or “toxic” financiers and focus on distressed situations. The debt may appear to have an attractive interest rate, masking the danger embedded in the conversion terms.

- The Floating Conversion Price: As outlined above, the conversion price is not fixed but floats, typically at a discount to the market price. Crucially, as the stock price falls, the conversion price also falls.

- The Lender’s Incentive: This structure creates a perverse incentive for the lender. Unlike a traditional lender who benefits from the borrower’s success, the death spiral lender profits most when the company’s stock price declines. A lower stock price means a lower conversion price, allowing the lender to convert their debt into significantly more shares of stock for the same principal amount.

- The Spiral: The lender, motivated to maximize the number of shares received upon conversion, often actively facilitates the stock price decline. A common tactic is aggressive short selling of the company’s stock, putting direct downward pressure on the share price. This falling price triggers a lower conversion price according to the debt agreement. The lender then converts a portion of the debt into a large block of newly issued shares at this depressed price. Subsequently, the lender often sells these newly acquired shares into the open market, further increasing supply and driving the price down even more. This creates a vicious cycle: heavy short selling -> lower stock price -> lower conversion price -> conversion into more shares -> selling of converted shares -> further stock price decline -> repeat.

- The Outcome: This downward spiral can continue relentlessly, fueled by the lender’s conversions and selling. The massive dilution resulting from the issuance of an ever-increasing number of shares at progressively lower prices decimates existing shareholders’ equity. Ultimately, the stock price can be driven to near-zero levels, often forcing the company into bankruptcy or liquidation, leaving shareholders with worthless stock. The lender, however, having converted debt at deep discounts and potentially profited from short selling, can emerge with substantial gains despite the company’s demise.

C. Why Companies Agree

Given the catastrophic potential, the question arises why any company would agree to such terms. The answer almost invariably lies in desperation. Companies resorting to death spiral financing are typically those that have exhausted other options. They may have been rejected by traditional banks and underwriters, face imminent insolvency or default, and view this toxic financing as the only available lifeline, however flawed. In some cases, management may not fully grasp the destructive implications of the variable conversion terms or may be poorly advised by intermediaries.

D. Devastating Consequences

The impact of death spiral financing extends beyond mere financial loss:

- Shareholders: Experience catastrophic dilution and often a near-total loss of their investment as the share price collapses.

- The Company: Is frequently pushed into bankruptcy, forced into distressed asset sales, or effectively ceases to operate as a going concern.

- Employees: Face job losses as the company falters and ultimately fails.

The structure of death spiral financing fundamentally alters the relationship between the lender and the company. Instead of providing capital with an interest in the company’s success for repayment, the toxic terms incentivize the lender to actively undermine the company’s stock price to maximize their own returns through the conversion mechanism. It is not merely a financing tool gone wrong; it is an instrument that can actively fuel the destruction of the borrower by turning the lender into an adversary with a direct financial interest in the stock’s collapse through tactics like aggressive short selling. This predatory dynamic underscores the extreme danger posed by financing arrangements with floating, discounted conversion prices.

The Broader Ecosystem of Penny Stocks Fraud: Pump-and-Dump Schemes

Beyond the perils of toxic financing, the penny stock market is notoriously plagued by market manipulation, with the “pump-and-dump” scheme being a classic and persistent form of fraud.

A. Defining Pump-and-Dump Manipulation

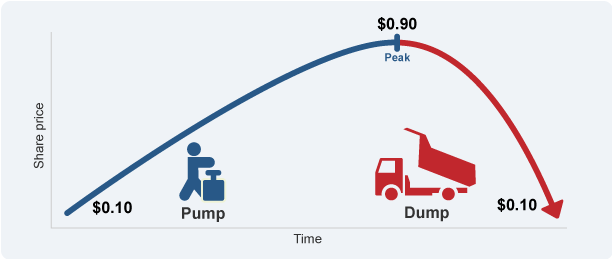

A pump-and-dump scheme is a deliberate and illegal form of securities fraud involving the artificial inflation (the “pump”) of a security’s price, typically a microcap stock, through the dissemination of false, misleading, or greatly exaggerated positive statements. The perpetrators, who have typically acquired shares of the stock cheaply beforehand, then sell (the “dump”) their holdings into the artificially inflated demand they created. Once the manipulative promotion ceases and the perpetrators’ selling pressure hits the market, the stock price typically collapses, leaving investors who bought during the hype with significant losses. This practice is explicitly illegal under securities laws and subject to severe penalties, including fines and imprisonment.

B. Anatomy of a Scheme

Pump-and-dump schemes generally follow a predictable pattern:

- Acquiring Shares (The Setup): The manipulators first establish a significant position in the targeted microcap stock. This is often done quietly and at low prices before the promotional activity begins. A crucial link exists here with toxic financing structures; warrants or shares obtained cheaply through private placements or convertible debt (potentially toxic) can provide the inventory needed for the eventual dump. Manipulators might also gain control of shares through the use of shell companies and reverse mergers, which allow private companies to become publicly traded with less scrutiny than a traditional IPO, providing a vehicle for the scheme.

- The “Pump” (Creating Artificial Demand): Once positioned, the fraudsters initiate a campaign to artificially boost interest and demand for the stock. This involves various tactics aimed at creating hype and luring unwitting investors:

- Misleading/False Information: Disseminating fabricated news or grossly exaggerating positive developments regarding the company’s contracts, products, earnings, potential acquisitions, or regulatory approvals. Questionable press releases distributed through legitimate news portals are a common tool.

- Social Media Blitz: Leveraging the power and reach of the internet, manipulators flood social media platforms (Twitter, Discord, Facebook, WhatsApp, Reddit, YouTube, TikTok) and online forums/chat rooms with promotional messages. This can be done anonymously, using fake profiles, or even impersonating legitimate sources. The speed and low cost allow fraudsters to reach vast audiences quickly.

- Stock Promoters & “Finfluencers”: Employing paid stock promoters to tout the stock through newsletters, emails, websites, or social media channels. Often, these promoters fail to disclose that they are being compensated, misleading investors into believing the recommendation is unbiased. The rise of “financial influencers” or “finfluencers” on social media has created a new avenue for such promotions, sometimes involving unlicensed individuals giving investment advice.

- Boiler Rooms & Cold Calling: While perhaps less prevalent than online methods today, the traditional approach of using high-pressure salespeople making unsolicited calls from “boiler rooms” to pitch stocks still occurs. See Addendum at the end of this article.

- Manipulative Trading: Supplementing the promotional hype with deceptive trading practices to create a false appearance of market activity and upward momentum. This can include “wash trading” (where a manipulator simultaneously buys and sells the same security through different accounts to create artificial volume), “spoofing” (placing large orders with no intention of executing them to create false impressions of supply or demand), or “layering” orders.

- Exploiting Psychology: Preying on investor emotions, particularly greed and the Fear of Missing Out (FOMO). Tactics include creating a sense of urgency (“Buy now before it takes off!”), promising unrealistic or guaranteed returns (“This is the next 100x penny stock!”), and making the opportunity seem exclusive.

- The “Dump” (Cashing Out): As the coordinated pumping activities successfully draw in buyers and inflate the stock price, the perpetrators begin to sell, or “dump,” their previously acquired shares. The selling is timed to coincide with the peak of the buying frenzy generated by the hype. Crucially, the manipulators typically do not disclose their selling activity while continuing to promote the stock. The sudden influx of sell orders from the dumpers overwhelms the artificial demand, the promotional efforts cease, and the stock price plummets rapidly. Investors who bought shares during the pump phase are left holding stock worth significantly less than their purchase price, often incurring substantial losses. Studies have shown average losses for investors caught in such schemes can range from roughly 30% to over 50%.

C. Common Targets and Vulnerabilities

Microcap and penny stocks remain the preferred targets for pump-and-dump schemes precisely because their inherent characteristics facilitate manipulation. Their low liquidity and small public float mean that a relatively small amount of buying activity, whether genuine or artificially induced, can cause disproportionately large price increases, making the “pump” phase easier to achieve. The general lack of reliable information and limited analyst coverage makes it easier for manipulators to spread false narratives without immediate contradiction. Trading on less regulated markets further contributes to the vulnerability. Similar vulnerabilities exist in the cryptocurrency market, where obscure, low-market-cap coins with low liquidity are frequent targets for pump-and-dump schemes.

D. Scalping: A Related Scheme

A related manipulative practice is “scalping.” In a scalping scheme, a promoter or influencer first acquires shares of a stock (often a penny stock). They then recommend that their followers or subscribers purchase the stock, typically highlighting potential upside but crucially without disclosing their own ownership or their intention to sell. As the recommendation drives buying interest and pushes up the price, the scalper sells their shares into that induced demand, profiting from the price increase they helped create. Like pump-and-dumps, scalping frequently utilizes social media platforms to reach potential victims.

E. The Evolution of Market Manipulation

The transition from traditional pump-and-dump methods, heavily reliant on physical infrastructure like boiler rooms and printed newsletters, to modern schemes leveraging the internet and social media represents a significant evolution in market manipulation. This shift has effectively lowered the barriers to entry for perpetrating such frauds. Social media platforms provide manipulators with tools for near-instantaneous, low-cost, and potentially anonymous communication to a vast, global audience. Platforms like Twitter, Discord, and WhatsApp enable not only the dissemination of hype but also the coordination of manipulative activities among groups and the recruitment of unwitting investors into the scheme. This technological enablement means that sophisticated pump-and-dump campaigns can be orchestrated with less capital and organizational structure than in the past. Consequently, these schemes have become more widespread and adaptable, posing significant challenges for regulators attempting to police these rapidly evolving digital spaces. The sheer volume of such schemes detected in various studies underscores the scale of the problem in the modern financial ecosystem.

Regulatory Oversight and Enforcement

A. The Legal Framework (U.S. Focus)

In the United States, the primary legislative tools used to combat securities fraud, including pump-and-dump schemes and misrepresentations related to financing, are rooted in the Securities Act of 1933 and the Securities Exchange Act of 1934. Section 17(a) of the ’33 Act prohibits fraud in the offer or sale of securities, while Section 10(b) of the ’34 Act and the corresponding SEC Rule 10b-5 outlaw the use of manipulative and deceptive devices in connection with the purchase or sale of securities. These broad anti-fraud provisions form the basis for most enforcement actions against manipulation.

Recognizing the specific vulnerabilities of the microcap market, Congress passed the Securities Enforcement Remedies and Penny Stock Reform Act in 1990. This led to the SEC enacting the Penny Stock Rules, which impose additional disclosure requirements on broker-dealers recommending or trading penny stocks for customers. Furthermore, the Financial Industry Regulatory Authority (FINRA), the self-regulatory organization overseeing broker-dealers, has rules prohibiting fraudulent and manipulative practices and requiring members to adhere to high standards of commercial honor and just and equitable principles of trade. Activities like pump-and-dump schemes, scalping, wash trading, and spoofing are illegal under this framework.

B. SEC Enforcement Actions

The U.S. Securities and Exchange Commission (SEC) plays a central role in enforcing these laws and actively pursues cases involving microcap fraud. Examples of SEC actions illustrate the range of misconduct targeted:

- Unregistered/Offshore Brokers: The SEC has charged firms, often based offshore, that act as unregistered broker-dealers for U.S. clients, facilitating pump-and-dump schemes by helping conceal beneficial ownership and executing manipulative trades (e.g., the case involving Costa Rica-based Moneyline Brokers).

- Promoters, Insiders, and Boiler Rooms: Actions frequently target individuals and entities directly involved in orchestrating schemes, including company insiders, paid stock promoters, and operators of boiler rooms engaging in high-pressure sales tactics.

- Social Media Manipulation: Recognizing the growing role of social media, the SEC has brought charges against individuals, including social media influencers, for using platforms like Twitter and Discord to promote stocks as part of pump-and-dump schemes, often without disclosing their intent to sell.

- Broker-Dealer Compliance Failures: The SEC has also focused on the gatekeepers, bringing actions against broker-dealers for having inadequate compliance programs to detect and report suspicious activity related to microcap stock trading, including failures to identify red flags associated with unregistered securities sales or file Suspicious Activity Reports (SARs).

- Regulation A Abuses: The agency has pursued issuers for failing to comply with the requirements of Regulation A, an exemption from full registration intended for smaller capital raises, such as by improperly changing offering terms or engaging in prohibited practices after obtaining qualification.

In addition to filing charges seeking penalties, disgorgement of illicit profits, and industry bars, the SEC can also issue trading suspensions in a security (typically for up to 10 days) when there are concerns about the accuracy of publicly available information or potential manipulation, halting trading to protect investors.

C. Canadian Regulatory Context (CSA/IIROC)

In Canada, securities regulation is primarily handled at the provincial and territorial level, coordinated through the Canadian Securities Administrators (CSA). The Investment Industry Regulatory Organization of Canada (IIROC), now part of the new Canadian Investment Regulatory Organization (CIRO), oversees investment dealers and trading activity on Canadian marketplaces.

Canadian regulators share concerns about market integrity and prohibit manipulative or deceptive conduct, including the dissemination of false or misleading information that could affect a security’s price. IIROC/CIRO rules address short selling practices, requiring orders to be marked appropriately (“short” or “short-marking exempt” for certain neutral strategies), mandating reporting of failed trades, and potentially requiring pre-borrow arrangements in specific situations. Regulators monitor for “abusive” short selling, although the debate continues regarding the regulation of activist short selling, where short sellers publicly disseminate negative research. The CSA has issued specific warnings regarding pump-and-dump schemes promoted through social media and encrypted messaging apps like WhatsApp, often involving offshore stocks.

D. The Regulatory Challenge

Despite these frameworks and enforcement efforts, regulating market manipulation remains a complex and ongoing challenge. The adaptability of fraudsters, who quickly exploit new technologies and communication channels, often keeps regulators in a reactive posture. The speed, anonymity, and global reach afforded by the internet and social media present significant hurdles for surveillance, investigation, and enforcement. Identifying perpetrators hiding behind pseudonyms or operating through offshore entities and obtaining evidence from encrypted platforms or foreign jurisdictions can be difficult. The sheer volume of potential manipulation, particularly in the microcap and crypto spaces, suggests that enforcement actions likely capture only a portion of the illicit activity. This dynamic underscores that while regulation provides an essential deterrent and means of recourse, it cannot eliminate the risk entirely. The adaptive nature of financial fraud necessitates continuous vigilance from investors themselves.

Investor Protection: Identifying Red Flags and Conducting Due Diligence

Given the prevalence of predatory financing and manipulation schemes in the microcap sector, investors must exercise extreme caution and develop the ability to recognize warning signs. Effective due diligence is paramount.

A. Red Flags for Toxic Financing

Investors should be particularly wary when encountering convertible debt instruments with the following characteristics:

- Variable/Floating Conversion Prices: This is the absolute hallmark of potentially toxic “death spiral” financing. Any term allowing the conversion price to adjust downwards based on the stock’s future market price should be considered extremely high risk.

- Deep Discounts: Conversion prices set at substantial discounts (e.g., 20%, 30% or more) to the market price at the time of conversion, especially when combined with a floating mechanism.

- History of Dilution: A company with a pattern of repeatedly resorting to highly dilutive financing rounds may be struggling financially and could be susceptible to or already engaged in toxic financing.

- Known Toxic Lenders: The presence of financing firms known to specialize in distressed or “vulture” financing structures should raise immediate concerns.

- High Short Interest: While not always indicative of manipulation, an unusually high level of short interest in a company that has recently undertaken convertible debt financing could signal that the lender (or parties associated with them) may be actively shorting the stock in anticipation of, or to facilitate, profitable conversions.

- Desperate Company Communications: Pay attention to the tone of management’s press releases and filings. Overly optimistic projections or language suggesting desperation in the face of clear financial difficulties can be a warning sign that the company might accept unfavorable financing terms.

B. Red Flags for Pump-and-Dump Schemes

Recognizing the signs of a potential pump-and-dump scheme requires skepticism towards promotional activities and anomalies in trading:

- Promotional Hype: Be highly suspicious of unsolicited emails, social media messages (posts, direct messages, chat groups), forum postings, or phone calls aggressively promoting a particular stock, especially a microcap. Claims of possessing “inside information” about imminent positive news are classic red flags.

- Unrealistic Promises: Beware of guarantees of extraordinarily high or rapid returns, often accompanied by pressure to invest immediately to avoid missing out (FOMO tactics). If an investment opportunity sounds too good to be true, it almost certainly is.

- Information Source Credibility: Question the source of the information. Be wary of recommendations from anonymous or pseudonymous individuals online, newly created social media accounts with no track record, or sources impersonating legitimate financial firms or media outlets. Always verify the registration status of anyone providing investment advice.

- Trading Anomalies: A sudden and dramatic spike in a stock’s price and/or trading volume, particularly in the absence of any verifiable, material news released by the company through official channels, is highly suspicious. Look for signs of coordinated trading activity among groups.

- Company Characteristics: Be extra cautious with stocks that are thinly traded, have limited publicly available information, or belong to companies that have recently undergone reverse mergers or frequent name changes, as these are common targets. Check if the company is current with its regulatory filings; a fifth letter “E” added to the ticker symbol on OTC markets can indicate late SEC filings.

- Affinity Fraud: Be cautious of investment pitches that specifically target members of an identifiable group (e.g., religious, ethnic, professional, or social groups), as fraudsters often exploit trust within these communities.

C. Essential Due Diligence Steps

To protect against these schemes, investors should adopt a rigorous due diligence process:

- Research the Company Thoroughly: Look beyond promotional hype. Access and carefully read the company’s official filings with regulatory bodies like the SEC (if available). Understand its business model, financial condition (revenue, profit, cash flow, debt), management team experience and track record, and corporate history. Maintain a critical and questioning mindset when reviewing any information.

- Verify Information Independently: Do not rely solely on information from unsolicited sources, social media, or promotional materials. Cross-reference claims with multiple, credible, independent sources (e.g., official company filings, reputable financial news outlets).

- Analyze Financing Terms: Scrutinize the terms of any recent financing arrangements, particularly convertible debt or warrants. Look specifically for variable conversion prices, deep discounts, or other potentially toxic features.

- Check Promoter Disclosures: If investment information originates from a newsletter, website, or individual promoter, investigate whether they have disclosed any compensation received for the promotion (who paid them, the amount, and the type of payment). Securities laws require such disclosure, but fraudsters often omit it.

- Monitor Short Interest: While high short interest alone isn’t proof of wrongdoing, it can be a relevant data point, especially in the context of other red flags. Investigate the potential reasons behind significant short positions.

- Consult Registered Professionals: Before investing in any security, especially complex or high-risk microcap stocks, consider discussing the opportunity with a trusted and appropriately registered financial advisor or investment professional.

D. Consolidated Red Flag Checklist

The following table provides a consolidated checklist of key warning signs associated with both toxic financing and pump-and-dump schemes:

| Category | Red Flag Indicators |

|---|---|

| Financing Red Flags | Variable/Floating/Floorless Conversion Price (Tied to Market Price) |

| Conversion Price at Deep Discount to Market | |

| Company History of Highly Dilutive Financings | |

| Involvement of Known “Toxic” or “Vulture” Lenders | |

| Desperate Tone in Company Communications / Overly Optimistic Projections Amid Distress | |

| Promotional Red Flags | Unsolicited Hype (Emails, Social Media, Calls, Texts) |

| Promises of Unrealistic / Guaranteed / High & Rapid Returns | |

| High Pressure to Buy Immediately (FOMO Tactics) | |

| Anonymous / Pseudonymous / Unverifiable Information Sources | |

| Claims of “Inside” or Secret Information | |

| Undisclosed Compensation for Promotion / Recommendation | |

| Trading/Market Flags | Sudden Spike in Stock Price and/or Volume Without Credible Company News |

| High or Rapidly Increasing Short Interest (Context-Dependent) | |

| Thinly Traded / Low Float Stock | |

| Frequent Company Name Changes / Reverse Mergers / Shifts in Business Focus | |

| Trading Primarily on OTC Markets (vs. Major Exchanges) | |

| Disclosure Red Flags | Lack of Transparency / Limited Publicly Available Information |

| Failure to Make Required Regulatory Filings on Time (e.g., “E” on Ticker) | |

| Vague or Overly Promotional Press Releases Lacking Substance |

E. Interpreting Red Flags

It is crucial to understand that the presence of a single red flag does not automatically confirm fraud. For instance, a company might legitimately use standard convertible debt, or a stock price might surge due to genuine positive developments. Social media discussions about stocks are also common and not inherently manipulative. However, fraudsters rarely rely on a single tactic; they often employ a combination of methods. The real danger signal emerges when multiple red flags appear concurrently. A struggling microcap company taking on debt with variable conversion terms, which is then suddenly and aggressively promoted by anonymous accounts on social media, accompanied by a sharp spike in trading volume without any official news, presents a far more compelling picture of potential manipulation than any single factor alone. Therefore, effective investor protection requires a holistic assessment. Investors should avoid reacting to isolated data points and instead look for patterns and the convergence of multiple warning signs identified in this report to make a more informed judgment about the potential risks involved.

ADDENDUM: Unveiling the Boiler Room

A boiler room is a high-pressure, often fraudulent operation that involves aggressive sales tactics to promote and sell stocks to unsuspecting investors. These operations often involve teams of salespeople, known as “boiler room brokers” or “pumpers,” who use deceptive and misleading information to hype up a stock and create a sense of urgency to buy.

How Boiler Rooms Operate

- Target Selection: Boiler rooms often target microcap stocks that are thinly traded and have limited public information available.

- The Pump: Boiler room brokers use high-pressure sales tactics, misleading information, and even outright lies to convince investors that a particular stock is a “sure thing” or a “once-in-a-lifetime opportunity.”

- The Dump: Once the stock price has been artificially inflated by the buying frenzy created by the boiler room, the insiders and promoters behind the scheme sell off their shares, leaving investors with significant losses.

The Role of Tout Sheets and Social Media

To amplify the impact of their boiler room operations, unethical insiders and promoters often employ additional tactics, such as:

- Tout Sheets: These are newsletters or websites that promote specific stocks, often with exaggerated or misleading claims. Tout sheets may be paid for by the insiders or promoters behind the scheme, creating a conflict of interest that is not always disclosed to investors.

- Social Media Influencers: In the age of social media, insiders and promoters may also hire social media influencers to promote a stock to their followers. These influencers may not always disclose that they are being paid for their endorsements, misleading their audience into believing they are providing objective opinions.

Protecting Yourself from Boiler Room Schemes

- Be Skeptical: Don’t believe everything you read or hear about a microcap stock. If something sounds too good to be true, it probably is.

- Do Your Research: Thoroughly investigate any company before investing, relying on independent research and objective data.

- Question Motives: Ask yourself why a promoter might be aggressively recommending a particular stock. Are they truly independent, or do they have a hidden agenda?

- Avoid High-Pressure Sales Tactics: Don’t be pressured into making quick investment decisions. Take your time, do your homework, and consult with a trusted financial advisor if needed.